Tax return depreciation calculator

The depreciation recapture is assessed when the sale price of an asset in this case a house exceeds the adjusted cost basis or tax basis. C is the original purchase price or basis of an asset.

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation is allowable as expense in Income Tax Act 1961 on basis of block of assets on Written Down Value WDV method.

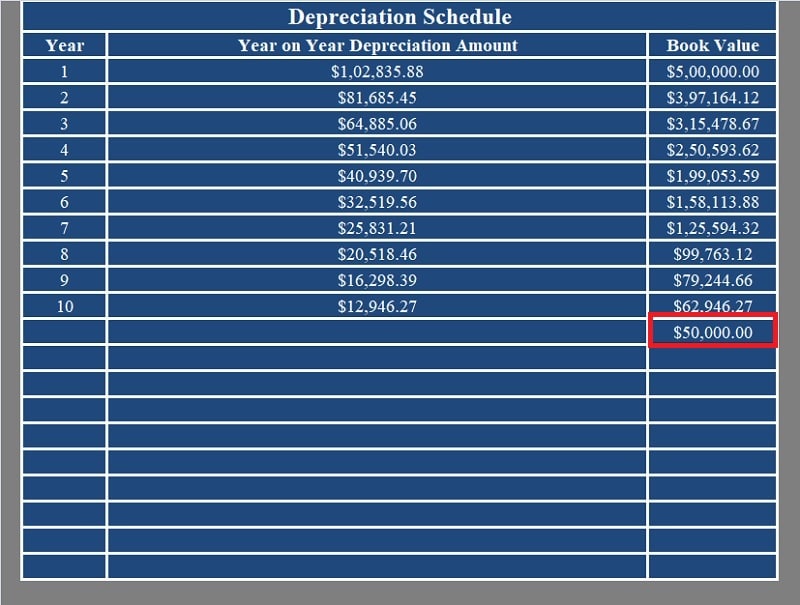

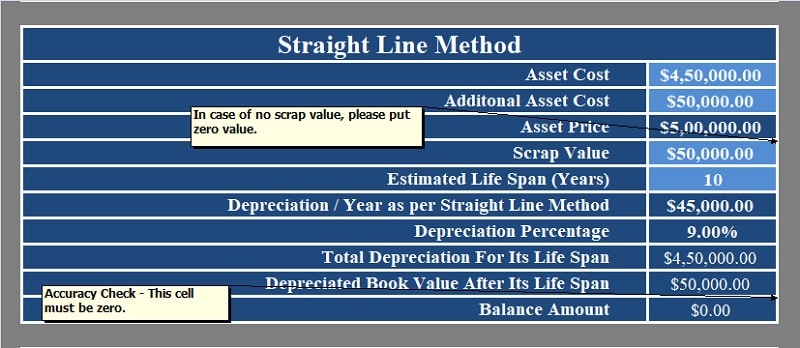

. Where Di is the depreciation in year i. By using the formula for the straight-line method the annual depreciation is calculated as. You are provided with a Tax Depreciation Schedule that.

A Tax Depreciation Schedule is prepared by a qualified Quantity Surveyor who calculates the available deductions for the property. If the computer has. Use ClearTax Depreciation calculator to calculate depreciation in both Straight Line Method SLM and Written Down Value Method WDV.

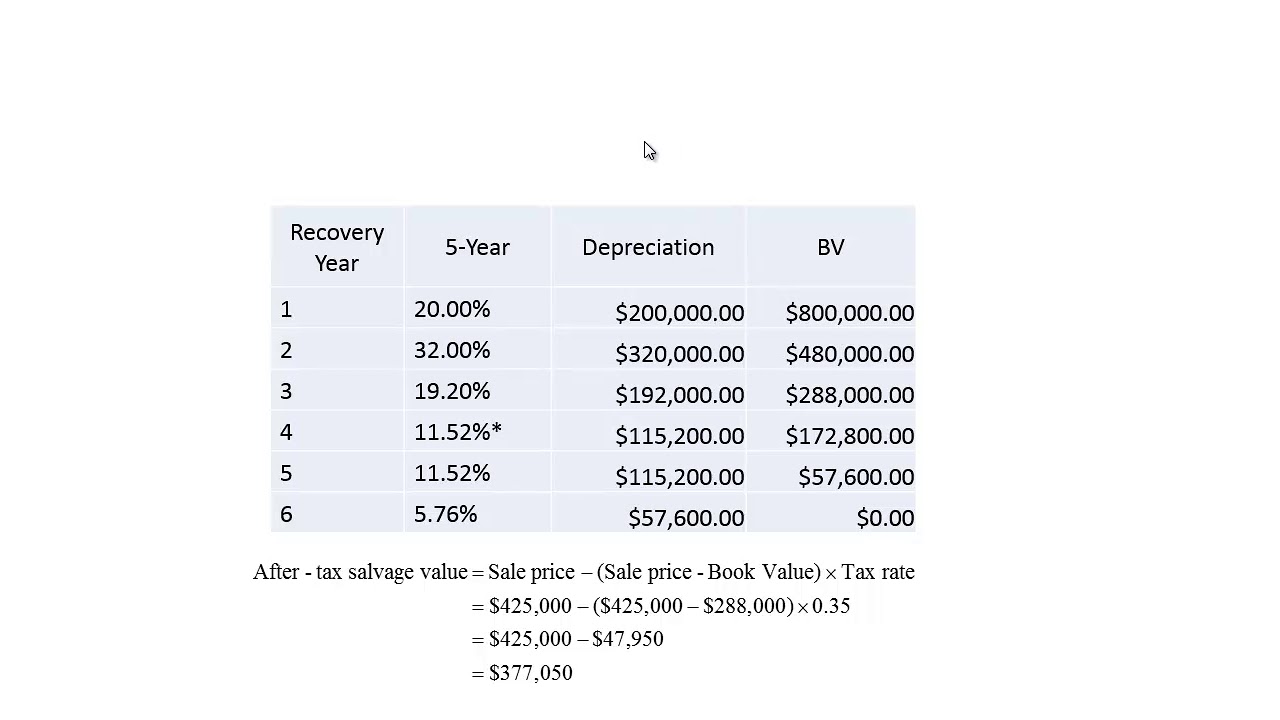

The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. If the computer has a residual value in 3 years of 200 then depreciation would be. It provides a couple different methods of depreciation.

The difference between metrics equal to the. 35000 - 10000 5 5000. Before you use this tool.

Depreciation on Straight Line Method SLM is not. Depreciation recapture tax rates. How to calculate what your Tax Refund will be when you submit your tax return to SARS Tax Refund.

How to calculate the tax payable on Pension Provident or Retirement Annuity Fund. You calculate depreciation as follows. First one can choose the straight line method of.

Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Every American has to. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1.

This depreciation calculator is for calculating the depreciation schedule of an asset. The computer will be depreciated at 33333 per year for 3 years 1000 3 years. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Above is the best source. D i C R i. You bought the property 250000 and 200000 of that was the value of the building rather than the land.

The tool includes updates to. Calculate your tax refund for free. This means the van depreciates at a rate of.

The MACRS Depreciation Calculator uses the following basic formula. The Tax Depreciation Calculators objective is to provide the property investor an indicative estimate of the tax depreciation deductions applicable on certain properties. Depreciation recapture tax rates.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to. Depreciation on Straight Line Method SLM is not. MACRS Depreciation Calculator Help.

Gas repairs oil insurance registration and of course.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Guide To The Macrs Depreciation Method Chamber Of Commerce

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Macrs Depreciation Calculator Irs Publication 946

Download Depreciation Calculator Excel Template Exceldatapro

1120 Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Straight Line Double Declining

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Macrs Youtube